Turning Childcare Expenses into a Tax Deduction and a Financial Investment

The second largest expense a family is often childcare. That’s why we’re crafting a groundbreaking approach that lets you turn your childcare expenses into a tax deduction and an investment.

In partnership with legal and financial experts, we're building a structure that transforms your childcare expenses into a meaningful family asset.

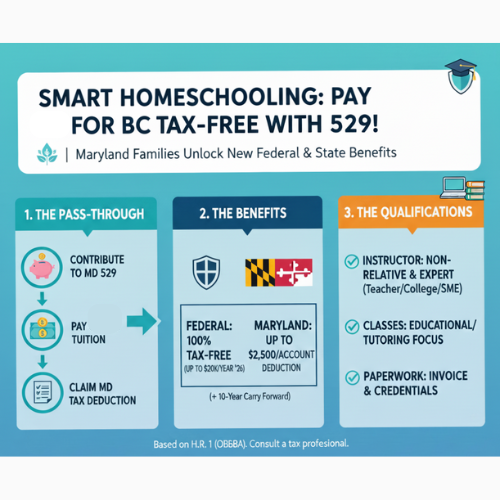

Per the One Big Beautiful Bill Act (H.R. 1), we can help our parents achieve nearly a 73% deduction in their federal taxes, and a smaller percentage in their Maryland state taxes (subject to change).

In other words, rather than simply covering childcare costs, you are saving in taxes and you’re investing in a model that may provide returns down the line. We’re here to help you make every dollar spent on childcare a stepping stone toward your family’s financial future.

Stay tuned as we turn this vision into reality!